感谢Danny(Managing Director, Money 20/20 Asia)的介绍,大家下午好!作为一位已经离开银行业11年的曾经的从业者,今天能够重新回到这个行业论坛,并与在座的各位同行交流,感到非常荣幸和骄傲,我们将一起探讨未来人工智能在金融业的发展。

Thanks Danny (Managing Director, Money 20/20 Asia) for the introduction, and good afternoon! As a practitioner who has been away from the banking industry for 11 years, I am very honored and proud to be able to return to the industry gathering today and communicate with all of you here. Together, we will discuss the development of artificial intelligence in the future.

大家可能还记得几年前《经济学人》发布的文章,讲述了数字银行的崛起以及大科技公司(如亚马逊和阿里巴巴)对传统银行业的挑战。作为一名曾经的银行从业者,我与银行界的许多朋友讨论过这个话题。有人认为这篇文章过于悲观,但它并不是给出一个结论,而是提出了一个值得深思的问题。几年前,我介绍杭州时会分享马云先生曾说的一句话:“如果银行不改变,我就会改变它们。”当然,现在马云不再像以前那样频繁谈论银行业了。

You may remember an article published by The Economist a few years ago about the rise of digital banks and the challenges that big tech companies (such as Amazon and Alibaba) have posed to traditional banking. As a former banker, I have discussed this topic with many friends in the banking world. Some people think that this article is too pessimistic, but instead of giving a conclusion, it raises a question worth pondering. A few years ago, when I introduced Hangzhou, I would share a sentence in which Jack Ma said, "If the banks don't change, I will change them." Of course, now Jack Ma doesn't talk about banking as much as he used to.

如果大家还没有读过那篇文章,我可以简单介绍一下它的内容。文章讨论了数字银行的崛起,尤其是大科技公司如亚马逊、阿里巴巴等对银行业带来的冲击,特别是人工智能技术的影响。文章还专门讨论了商业模式的转变,诸如开放银行、数据治理等问题,强调了数据共享的重要性。同时,它也提到,传统银行的角色正在发生变化,作为传统银行从业者,你必须重新定义自己在行业中的定位。当然,普惠金融也是一个关键话题,普惠金融、区块链以及加密货币等议题同样引起了广泛关注。文章还谈到了监管挑战,这是我们必须面对的重大难题。此外,可持续性和绿色金融问题也被提到,尤其是在疫情期间(文章是在疫情期间),疫情加速了数字化转型的进程。

If you haven't read that article yet, I can give you a brief overview of what it's about. The article discusses the impact of the rise of digital banking, especially big tech companies such as Amazon and Alibaba, on the banking industry, the impact of artificial intelligence technology. The article also specifically discusses the transformation of business models, such as open banking, data governance, and other issues, emphasizing the importance of data sharing. At the same time, it also mentions that the role of traditional banks is changing, and as a traditional banker, you have to redefine your position in the industry. Of course, financial inclusion is also a key topic, and topics such as financial inclusion, blockchain, and cryptocurrencies are also gaining traction. The article also talks about the regulatory challenges, which we have to face. In addition, sustainability and green finance issues were also raised, especially during the pandemic, (when the article was published) which accelerated the process of digital transformation.

如果回顾近年来中国政府提出的五项重点金融服务任务,其中有三项已经在上述文章中提到——绿色金融、普惠金融和数字金融。另外两项是科技金融和养老金融。这些任务的提出表明,金融行业正在朝着技术创新、社会服务等多个领域发展。总的来说,我们可以看到,尽管面临技术、竞争和监管的挑战,但金融行业面对科技巨头的竞争依然充满了机遇。如今,距离那篇文章发布已经过去四年,文章中提到的技术与金融的深层融合趋势仍在持续。

If we look back at the five key financial service tasks proposed by the Chinese government in recent years, three of them have already been mentioned in the above article – digital finance, green finance and inclusive finance, and the other two are technology finance and retirement finance. The proposition of these tasks shows that the financial industry is developing towards many fields such as technological innovation and social services. Overall, we can see that despite the technological, competitive, and regulatory challenges, the financial sector is still full of opportunities with the competition of tech giants. Now, four years after that article was published, the deep integration trends in technology and finance mentioned in the article are still continuing.

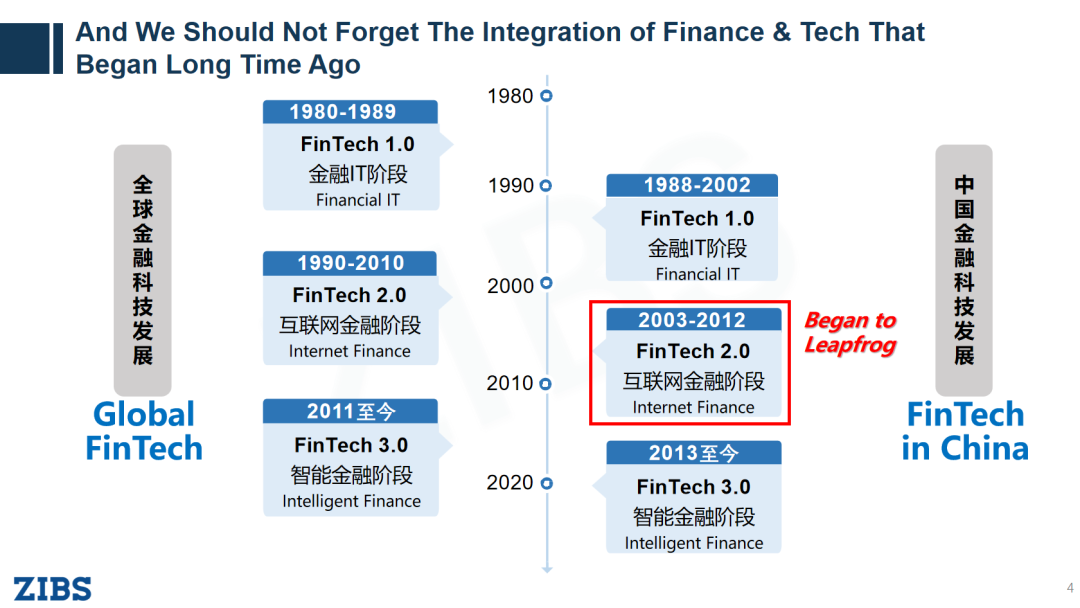

对于在座的金融同行们来说,我们应当感到自豪,因为我们一直是最早采用新技术的行业之一。正如从信用卡到自动柜员机(ATM)的经历,再到我曾在银行工作时使用客户管理系统(CRM)的工作经验,我们可以看到,金融行业相较于许多其他行业,确实走在了前列。作为一名观察者和研究者,我认为,若从1980年开始回顾金融科技(Fintech)的发展,我们可以将其划分为几个阶段。虽然我们并不算非常“老”,但这个历程是值得回顾的。

For our financial peers here, we should be proud that we have been one of the first industries to adopt new technologies. As we can see from Credit Cards to the ATM to my experience working with CRM (Customer Relationship Management), we can see that the financial industry is really at the forefront compared to many other industries. As an observer and researcher, I believe that if we look back at the development of financial technology (Fintech) from 1980, we can divide it into three stages. Although we are not very old, this journey is worth looking back.

金融科技发展的第一阶段的内容大家都熟悉,因此不再赘述。第二阶段,我们称之为互联网金融。正如Danny所提到的,实际上,11年前我创办了浙江大学互联网金融研究院。而在那个时候,“Fintech”这一词汇并未广泛流行,因此我们不得不创造出这个概念。那时,我们讨论的是“谁与谁”的在线互联金融,便通过字面翻译成了“互联网金融”。这个定义一直沿用至今。回顾从1990年代起,互联网逐渐成为我们日常生活的一部分,时至今日,已超过20年。在这个时期,我们迎来了“移动银行”的出现,支付宝也逐步成型。随后,在全球范围内,大约15年前,金融科技进入了一个新的阶段(第三阶段),即“智能金融”或“智慧金融”的时代。

The content of FinTech’s first phase is familiar to everyone, so I will not repeat it. The second stage is called Internet Finance. As Danny mentioned, in fact, 11 years ago I started the Academy of Internet Finance, Zhejiang University. And at that time, the term "Fintech" was not widely popular, so we had to create the concept of Internet Finance. At that time, we were talking about "who-to-whom" networked finance, which literally translated into "Internet Finance". This definition is still in use today. Back in the 1990s, the Internet gradually became a part of our daily lives, and it has been about 20 years now. During this period, we ushered in the emergence of "mobile banking", and Alipay gradually took shape. Subsequently, globally, about 15 years ago, fintech entered a new phase, the era of "intelligent finance" or "smart finance".

作为一位身处中国、身在杭州的人,我亲眼见证了阿里巴巴与蚂蚁集团的成长。观察中国金融科技的演进,我认为中国的起步较晚。1988年,我们才迎来了第一台ATM机,因此我视这一天为中国金融科技的起点。进入2003年,我们开始步入所谓的“互联网金融”时代。为什么是2003年?那年不仅是非典时期,支付宝也在同一年诞生。因此,2003年是一个具有标志性意义的时间节点,而杭州作为支付宝的发源地,也成为了中国互联网金融及金融科技的起源地。这一阶段大约持续了10年,在这段时间里,发生了许多变化。随着iPhone的发布,智能手机在中国的普及促使了智能银行的发展。

As a person in Hangzhou in China, I have witnessed the growth of Alibaba and Ant Financial. Looking at the evolution of fintech in China, I think China started late. It was only in 1988 that we had our first ATM, so I see this day as the starting point for China to embrace the idea of fintech. In 2003, we began to enter the era of so-called "Internet Finance". Why 2003? That year not only marked the beginning of SARS, but Alipay was also born in the same year. Therefore, 2003 is a landmark time, and Hangzhou, as the birthplace of Alipay, has also become the origin of China's Internet finance and financial technology. This phase lasted about 10 years, and during this time, many changes took place. With the release of the iPhone, the popularity of smartphones in China has prompted the development of smart banking.

2013年,作为学者,我们开始预测,金融行业将进入“智能金融”时代。为什么是2013年?这同样与支付宝相关,因为在这一年,支付宝推出了名为“余额宝”的小额理财产品。三个月内,余额宝便成为中国最大的理财平台,管理资产超过6000亿人民币,主要依托支付宝平台。这个现象具有极强的教育意义,它让几乎每个中国消费者都能够说:“我也是一个理财客户”。这一点极大地激励了许多学生参与其中。

In 2013, as scholars, we began to predict that the financial industry would enter the era of "smart finance". Why 2013? This is also related to Alipay, because in this year, Alipay launched a small wealth management product called "Yu’E Bao". Within three months, Yu'E Bao became China's largest wealth management platform, with more than 600 billion yuan in assets under management, mainly relying on the Alipay platform. This phenomenon is highly educational, and it allows almost every Chinese consumer to say, "I am also a wealth management customer". This has greatly motivated many students to get involved.

接下来,从理论的角度来看,我认为中国的金融科技发展确实有些类似于“弯道超车”。回顾我在汇丰工作的时候,我曾向交通银行(我开户的银行)抱过怨,作为消费者,我每每在午餐时间排很长队等候,办理业务。那时,汇丰银行是全球最大的银行之一,也是交通银行的战略股东,然而排队现象依旧频繁出现。基于我工程背景的思考,我们开始设想,如果能够改善这一过程,创新金融产品与服务流程,将会带来怎样的变革。

Next, from a theoretical point of view, I think that China's fintech development is indeed somewhat akin to "leapfrog". Looking back on my time at HSBC, I complained to the Bank of Communications that, as a consumer, I always had to wait in long line at lunch time. At that time, HSBC was one of the largest banks in the world, and a strategic shareholder of Bank of Communication, but queues were still frequent. Based on my engineering background, we began to imagine what kind of change would be brought about if we could improve this process and innovate financial products and services.

2018年,我为清华大学出版社撰写了一本关于互联网金融的教材。在书中,我指出,我们应当确保每个人都理解我们所讨论的内容。为了帮助学生更好地理解,我将金融科技比作一栋房子。房子的地面层代表基础设施,而二楼则是金融服务的具体展现。基础设施包括了区块链、人工智能、物联网、云计算等技术的融合,此外,还有信用打分模型、支付基础设施、5G、大数据等。这些技术共同构成了基础设施的核心部分。在这个房子中,上方代表金融行业的参与者。支付高速公路是基础设施的一部分,而金融行业的数字化则意味着传统银行的数智化转型。例如,阿里系的网上银行和腾讯的“微众银行”是互联网银行的代表,以及智能投顾和其他新兴金融服务则是那些曾经不存在的服务的典型代表。这一模型便是我们在教科书中所使用的框架。

In 2018, I wrote a textbook on internet finance published by Tsinghua University Press. In the book, I argue that we should make sure that everyone understands what we are discussing. To help students understand better, I've likened it to a house. The ground floor of the house represents the infrastructure, while the second floor are different players of financial services. The infrastructure includes the integration of blockchain, artificial intelligence, Internet of Things, cloud computing and other technologies, in addition, there are credit scoring models, payment infrastructure, 5G, big data, etc. Together, these technologies form a core part of the FinTech infrastructure. In this model, the top represents the participants in the financial industry. The payment highway is part of the infrastructure, and the digitalization of the financial industry means that traditional banks must transform themselves. Alibaba's MyBank and Tencent's WeBank are examples of pureinternet banking, while robo-advisors and other emerging financial services, are typical of these once-non-existent services. This model is the framework we use in our textbooks.

接下来,我想谈谈这一些变革过程中的关键里程碑。首先是2007年iPhone的推出,接着是2013年的余额宝,2023年的ChatGPT,而我们现在讨论的DeepSeek则是2025年最新的AI视角。它源自杭州。你可以发现,iPhone代表了高端技术产品,和ChatGPT一样属于相对高端、独特的创新,它非常先进但并不普及;与此不同,余额宝和DeepSeek则更加包容且具有可负担性。这是因为中国这样的发展中国家需要找到一种商业模式,能够接触到那些无法或不愿支付高额费用的人群,且服务必须具备灵活性和适应性。

Next, I'd like to talk about some of the key milestones along the way. First came the launch of the iPhone in 2007, then 2013 the development of money market fund (Yu’E Bao), then ChatGPT in 2023, and we are now talking about the latest AI perspective in 2025. "DeepSeek", which originated in Hangzhou. You can find that the iPhone represents high-end technology, and ChatGPT is also a relatively high-end, unique innovation, which is very advanced but not too popular. In contrast, Yu’E Bao and DeepSeek are more inclusive and affordable. This is because developing countries like China need to find a business model that can reach those who are unable or unwilling to pay high fees, and services must be flexible and adaptable.

随着AI和技术加速转型,基本对应《经济学人》文章的起始时间,我用一个图表对比了2020年末与2024年末的变化。你可能不想跟踪最近几个月的数据,因为它们的波动太大。你会看到,在这四年里,左边是2020年全球最具价值的公司,右边则是四年后的变化。首先,巨型科技公司依然占据主导地位,但值得注意的是,与AI相关的公司,如英伟达和台积电,表现尤为出色。Visa和Mastercard虽然是提供金融服务的公司,但我更倾向于将它们视为科技公司,因为它们实际上更多提供的是网络和服务。

As the transformation of AI and technology accelerates, I used a chart to compare the changes in late 2020 with the end of 2024. You may not want to track the recent data because they fluctuate very much. You'll see that in those four years to correspond roughly with the time since The Economist article was published, on the left is the world's most valuable companies in 2020, and on the right is the changes after four years. First, giant tech companies remain dominant, but it's worth noting that AI-related companies, such as NVIDIA and TSMC, are doing particularly well. Visa and Mastercard, are extremely valuable companies, I’m more inclined to think of them as tech companies because they are actually more about networking and services.

至于中国,尽管我身处其中,我不能虚构数据。中国的表现相对较为逊色,直到最近,台积电一直是中国的唯一代表。我必须承认这一点。在某些场合,我作为商业教授,向我的美国朋友展示这些数据时,我会告诉他们:“你们几乎在所有领域都处于领先地位,没什么好担心的。”对我个人而言,作为中国人,我看到的最大机会是,中国的大型银行需要进行技术转型,AI技术的应用迫在眉睫。

As for China, even though I'm in it, I can't fabricate data. China's performance has been relatively inferior, and until recently, TSMC was the only one from China. I must admit it. On some occasions, when I, as a business professor, show this data to my American friends, I tell them, you're leading in almost everything, there's nothing to worry about. For me, personally, as a Chinese, the biggest opportunity I see is that China's large banks need to undergo technological transformation, and the application of AI technology is imminent.

接下来,我们看到的是全球十大银行按资产排名的情况。我们这儿讨论的并非印尼盾等小型货币,而是以万亿美元计算的美元资产。中国四大国有银行——工商银行、建设银行、农业银行和中国银行——稳居世界前列。作为其中一家银行的监事会成员,我不能透露过多信息,但可以看到,这些银行依然在资产规模上持续增长。然而,值得注意的是,中国的银行在应用技术方面通常较为保守,资本市场似乎尚未充分认可或接受它们。这些银行的市盈率(P/E)相对较低,原因在于它们的自我转型进程尚不够快速和高效。

Next, we see the ranking of the top 10 global banks by assets. We are not talking about small currencies such as the rupiah, but US dollar assets in trillions of dollars. China's four largest state-owned banks – Industrial and Commercial Bank of China, China Construction Bank, Agricultural Bank of China and Bank of China – are among the top in the world. As a member of the supervisory board of one of these banks, I can't give too much information, but I can see that these banks continue to grow in terms of assets. However, it is worth noting that Chinese banks are generally conservative in the application of technology, and the capital markets do not seem to have fully recognized or appreciated them. The price-to-earnings (P/E) ratios of these banks are relatively low because their digital transformation process has not been fast and efficient enough.

如果我们看看微众银行和网商银行,它们可能是全球最具AI和技术驱动的银行之一,但由于种种原因,它们未能如预期般快速发展。这些中国国有银行的转型步伐较慢,尤其是一些大型银行,往往仍处于技术转型的早期阶段,而未完全进入AI时代。我的看法是,这对于全球,尤其是东南亚等发展中国家而言,是一个巨大的机会。这些地区的传统银行也面临着转型的巨大需求。

If we look at WeBank and MyBank, they may be among the most AI- and technology-driven banks in the world, but they haven't been able to grow as fast as expected for a variety of reasons. The pace of transformation of these Chinese stated-owned banks, especially some large banks, is often still in the early stages of technological transformation and has not yet fully entered the AI era. My view is that this is a huge opportunity for the world, especially for developing countries such as Southeast Asia. Traditional banks in these regions face a huge need for transformation as well.

接下来,关于中国的证券公司,目前中国大约有146家证券公司,其中排名靠前的10家,其市值总额相当于同行业的摩根斯坦利一家的市值。许多公司依然滞后,未能充分发挥其潜力。

Next, regarding China's securities companies, there are currently about 146 securities companies in China, of which the total market value of the top 10 is equivalent to that of Morgan Stanley. Many companies are still lagging behind and not reaching their full potential.

展望未来,AI的应用将成为一个关键的转折点。从客户服务到欺诈检测与预防,从个性化银行推荐到信用评分和风险评估优化,AI技术的应用将改变整个金融行业。正如我之前提到的,AI将在提升效率、降低成本、优化服务等方面发挥巨大作用。

Looking ahead, application of AI will be a key turning point. From customer service to fraud detection and prevention, from personalized bank recommendations to credit scoring and risk assessment optimization, the application of AI technology will transform the entire financial industry. As I mentioned earlier, AI will play a huge role in improving efficiency, reducing costs, optimizing services, and more.

在这里我列出了一些最佳实践,如果你们有兴趣深入了解,可以关注一些具有创新性的案例。这些公司在风险管理、实时审批(RTA)等方面的操作效率非常高,为金融行业的数字化转型提供了宝贵的经验。有些应用非常适用于交易策略。我相信在座的许多人已经在监管和报告领域应用这些技术,如KYC(了解你的客户)和AML(反洗钱)。这些过程如今变得越来越繁琐和昂贵,AI会大大降本增效。AI的应用在支付领域也在持续增长。

Here, I've listed some best practices, and if you're interested in digging deeper, you can look out for some innovative examples. These companies operate with high operational efficiency in areas such as risk management, real-time approval (RTA), etc., and provide valuable experience for the digital transformation of the financial industry. Some of them are very applicable to trading strategies. I'm sure many of you are already applying these techniques in the areas of regulation and reporting, such as KYC (Know Your Customer) and AML (Anti-Money Laundering). These processes are becoming more cumbersome and expensive today, a great opportunity for AI application. The use of AI continues to grow in the payment space.

接下来,我想谈谈自动化银行,或有时被称为嵌入式银行技术,或者智能银行模式,几乎没有人工干预。这种模式的典型例子是支付宝在一些微型贷款中的应用,采用他们的“3,1,0,0”模式,即零干预。这个例子表明,AI与银行业务的融合展现出了巨大的潜力。然而,我们也面临一些挑战,如偏见和透明度问题,以及监管方面的困境。

Next, I want to talk about automated banking, or sometimes referred to as embedded banking technology, or smart banking models with little to no human intervention. A typical example of this model is Ant Group’s some micro-loans business, employing their "3,1,0,0" model, i.e., zero intervention. As a example, the convergence of AI and banking shows great potential. However, we also face some challenges, such as bias and transparency issues, as well as regulatory dilemmas.

我对新加坡的监管措施印象深刻,几年前他们谈到过FEAT(公平、伦理、问责和透明度)。我认为这一框架非常简洁,它涉及隐私问题,也包括工作岗位的流失。随着这些结构性变化,我们也看到一些趋势,例如,现在的金融硕士毕业生未必会进入银行业工作。这其实是件好事,因为仅仅拥有金融硕士学位并不意味着你就只想着在金融机构工作。

I'm very impressed with the regulatory measures in Singapore, they talked about FEAT (fairness, ethics, accountability and transparency) a few years ago. I think it's a very concise framework, and it deals with privacy issues, but also job losses. With these structural changes, we are also seeing some new trends, such as the fact that today's Master of Finance graduates may not necessarily go into the banking industry. This is actually a good thing, because just having a master's degree in finance doesn't mean you're focused only on a job in banking.

下面我来说说我的团队的“全球金融中心城市”——这个我从2017年开始就做的课题。我们从三个角度来构建金融科技发展指数(FDI),即产业、消费者与生态。产业既包括金融科技行业中的新金融科技企业,我从选中每个城市拥有的正上市的及外部融资超过5000万美元但未上市的,也包括各城市金融机构的数字化转型。第二个角度则是消费端的体验,尤其是中小型企业和消费者体验。而第三也是最关键的是从复杂的生态系统角度去理解,这更像是从公共部门或政府的视角来考虑。这个视角包括经济基础如GDP、人口的年龄结构,以及金融行业的基础,尤其是该地区或城市中最有价值的金融企业或科技公司、全球500强企业等。

Let me share a research project by our ZIBS's team —— Global Fintech Hub Index, which are started from 2017. We look at Fintech Development Index(FDI) from three dimensions, industry, consumer and eco-system. Industry includes the alternative fintech enterprises in that city, both publicly-listed ones and those unlisted but with siginificany size(more than US$50 million funding raised from VC), we also include the digitalization of financial insititutions headquartered in the city. On the other hand, the consumer-side experience, especially for small and medium-sized businesses, is also becoming increasingly important. The most important thing is to understand it from the perspective of a complex ecosystem, which is more like thinking from the perspective of the public sector or government. This perspective includes the economic base, GDP, age structure of the population, infrastructure of the financial industry, especially the most valuable financial companies or technology companies in the region or city, Fortune 500 companies, etc.

此外,数字基础设施、网络安全、互联网普及率和研究能力等因素也需要考虑。例如,浙江省计划投入约2700亿人民币用于研发,占当地GDP的3%。当然,大学的规模和质量、政策环境、政府支持和监管能力也是重要因素。我们FDI指标体系总共涵盖了50个不同的指标,涉及全球80多个国家和城市及其集群。迄今为止我们已经发布了超过30份报告,可惜其中三分之二是中文的。因此,我们未来计划利用AI将其翻译成英文,以便在更广泛的范围分享。

In addition, factors such as digital infrastructure, cybersecurity, internet penetration, and research capabilities also need to be considered. Zhejiang Province, for example, each year invest about 270 billion yuan in R&D, accounting for 3% of the local GDP. Of course, the size and quality of the university, the policy environment, government support and regulatory capacity are also important factors. In total, we cover 50 different indicators across over 80 countries and cities around the world and their clusters. We have published more than 30 reports, but unfortunately two-thirds of them are in Chinese. And we plan to apply AI to translate these into English for wilder circulation.

我们试图覆盖全球主要城市,这是名单,如果你来自的城市不在其中,请告诉我。我们的这个研究中,在亚洲包括澳大利亚。请不要怪我可能有偏见。

We try to cover major cities around the wolde. If you are from a city that is not one of them, please let me know. For this study in Asia includes Australia. Don't blame me for being biased.

但基于上述这些数据,我们创建了一个类似排行榜的工具,列出了全球前50名的金融科技城市。我们讨论的是城市或集群。例如,旧金山作为一个城市过于狭小,因此我们将硅谷作为整体纳入考虑,苏黎世和日内瓦也过于小巧,因此我们将它们视为瑞士的一个集群。接下来,我会暂停几秒钟,给大家一些时间查看,如果感兴趣,欢迎进一步了解。

Based on the above data, we created a league table that lists the top 50 fintech cities in the world. We're talking about cities or clusters. For example, San Francisco is too small as a city, so we consider Silicon Valley as a whole, and Zurich and Geneva are too small, so we see them as a cluster in Switzerland. Next, I'll pause for a few seconds to give you some time to review, and if you're interested, welcome to learn more.

一个明显的趋势是竞争力的变化。根据我们的数据,过去五年,全球前10名城市之间的差距显著缩小。同时,几乎所有排名前10之外的城市,它们的排名都有所变化,这显示出全球金融科技领域的动态变化。东南亚地区的曼谷、雅加达、吉隆坡、新加坡等代表性城市已经进入了全球前50名,其中新加坡成为全球最国际化的金融科技中心之一。有趣的是,所有城市都在努力竞争。即使有16个城市的排名有所下降,但它们的绝对分数反而有所提高。这并不意味着这些城市没有努力,相反,它们正在不断提升。

One clear trend is the change in competitiveness. According to our data, the gap between the top 10 cities in the world has narrowed significantly over the past five years. At the same time, almost all cities outside the top 10 have seen changes in their rankings, showing the dynamics of the global fintech sector. Representative cities such as Bangkok, Jakarta, Kuala Lumpur and Singapore from Southeastern Asia region have entered the top 10 in the world, with Singapore becoming one of the world's most international fintech hubs. Interestingly, all cities are competing very hard. Even though 16 cities fell in the rankings, their absolute scores improved. This does not mean that these cities are not making efforts, on the contrary, they are constantly improving.

最后,在做小结之前,我需要补充一点。Danny,你总是提到这些是来自东南亚的高级银行家,而我之所以被邀请,是因为我有一些银行经验,对吗?如果我只是一个纯学术的人,我觉得可能没有机会在这里发言。因此,我尝试与大家分享一些观察,并提供一些我认为对各位有价值的建议。

Finally, before I wrap up, I need to add a little more. Danny, you always mention that these are senior bankers from South East Asia, and I was invited because I have some banking experience, right? If I were just a purely academic person, I don't think I would have had the opportunity to speak here. So I'm trying to share some observations with you and offer some advice that I think is valuable.

我先请教了ChatGPT,这些是系统最后给出的建议。首先,AI是一个催化剂,不仅仅是一个工具,它不仅仅关注成本削减和运营效率,而是引领新的商业模式和价值创造。它代表了一种文化和思维的变革。为了适应这一变革,我们需要培养具备AI素养的人才,从内部培养人才,并鼓励跨境、跨行业的合作,尤其是与学术界的合作。生态系统的领导者需要理解监管者的角色,掌握伦理AI的应用,探索新的商业模式和以客户为中心的服务。

I have asked ChatGPT about this question, and these are the responses. First, AI is a catalyst, not just a tool, it focuses not just on cost reduction and operational efficiency, but on leading new business models and value creation. It represents a cultural and mindset change. To adapt to this change, we need to nurture AI-literate talent, nurture talent from within, and encourage cross-border and cross-industry collaboration, especially with academia. Ecosystem leaders need to understand the role of regulators, master the application of ethical AI, and explore new business models and customer-centric services.

同时,关注普惠金融和数字化转型问题。所有的颠覆,无论是支付侧的支付宝或微信支付,还是其他金融科技的创新,关键都在于专注于客户服务。而许多中国的大型银行,坦白说,做得并不好,尤其是在客户服务方面。做好一些小的事情,建立客户信任,逐步创造收入流,并向你的老板展示成果,证明你已经取得了良好的回报,现在是时候扩大规模了。当然,还需要确保对全球AI和金融科技的格局进行持续监控。

At the same time, focus on financial inclusion and digital transformation. The key to all disruptions, whether it's Alipay or WeChat Pay on the payment side, or other fintech innovations, is to focus on customer service. And many of China's big banks, frankly, don't do a good job, especially when it comes to customer service. Do the small things well, build customer trust, gradually create revenue streams, and show your boss the results to prove that you've made good returns, and now it's time to scale. Of course, there is also the need to ensure that the global AI and fintech landscape is constantly monitored.

小结一下,不要将AI或任何技术仅仅视为工具或套路,它代表的是一种战略文化和业务转型的核心。AI不仅是为了提高运营效率,更重要的是能够创造全新的商业模式、提升客户体验,并推动普惠金融。

To sum up, don't think of AI or any technology as just a tool or a trick, it represents the core of a strategic culture and business transformation. AI is not only about improving operational efficiency, but more importantly, it can create new business models, enhance customer experiences, and drive financial inclusion.

接下来,我也分享一下我请教DeepSeek相同的问题,我们获得一些相似的观点。例如将AI视为战略合作伙伴,优先考虑数据治理和生态系统合作。需要关注人才,即从内部培养或吸引新的人才,并继续加强与监管机构的合作。或许正是因为DeepSeek源自中国,它也建议你们借鉴中国在AI金融科技领域的操作手册,并进行本地化调整。你可以效仿中国的一些最佳实践,但需要本地化,并专注于那些具有即时投资回报率(ROI)的应用案例。

Next, I have also sought answers from DeepSeek by asking the same question, we got some similar perspectives. For example, treat AI as a strategic partner, prioritize data governance and ecosystem collaboration. There is a need to focus on talent, i.e. developing or attracting new talent from within, and continuing to strengthen cooperation with regulators. Perhaps because DeepSeek is originated in China, it recommended that you borrow from China's operating manual in the field of AI fintech and adapted it locally. You can emulate some of China's best practices, but you need to localize and focus on those use cases that have an immediate return on investment (ROI).

正如我之前所说,做好一些小的尝试,确保能够建立信心,形成灵活的治理结构,并为下一个AI时代做好充分准备。可以说,下一步就是立即行动。我十分赞同DeepSeek关于建立东南亚AI行业联盟的建议,我也相信ZIBS可以有所作为。或许一年内,我们可以共同推动这项工作,能与各位行业领袖展开持续对话和能为东南亚的领先企业贡献自己的力量将是我的荣幸。

As I've said before, make small attempts to make sure you can build confidence, form a flexible governance structure, and be fully prepared for the next era of AI. The next step, so to speak, is to act now. I strongly agree with the recommendations by DeepSeek that we should consider establishing a Southeastern Aisa AI Council and believe that ZIBS should be able to contribute. Maybe in a year's time, we can move this work forward together. It would be a privilege to have continuous dialogue with the industry leaders in China and the Southeastern Asia region and to contribute to the development of leading companies in Southeast Asia.

在DeepSeek的背后是浙江大学和梁文锋先生,现在要见到他可能并不容易,甚至英伟达的黄仁勋这次在中国访问也没有见上。这张照片,他和浙江大学领导一起与中国的李强总理进行了对话。很多人可能不清楚浙江,位于上海旁边,拥有约6600万人。浙江大学是一所历史悠久且享有极高声誉的学校,专注于STEM(科学、技术、工程和数学)领域。我们有大约18,000名博士生。所以,当我们提到中国人口红利消失、出生率下降时,我们不禁思考,也许我们现在有的是“工程师红利”,因为来自中国的工程师成本相对较低(和硅谷相比)。

Behind the DeepSeek is Zhejiang University, I would say that it may not be easy to meet Mr. Liang today, and even NVIDIA's Jensen Huang did not meet him in his recent trip to China. This photo shows Mr. Liang and the leadr of Zhejiang University had a dialogue with China's Premier Li Qiang. Many people may not know that Zhejiang, located next to Shanghai, is a province with about 66 million people. Zhejiang University is a school with a long history and excellent reputation, focusing on STEM (science, technology, engineering, and mathematics) fields. We have about 18,000 PhD students. So, when we mention the disappearance of the Chinese population dividend and the decline in the birth rate, we can't help but think that maybe we have an "engineer dividend" now, because the cost of engineers from China is relatively low (compared to Silicon Valley).

接下来,谈谈ZIBS的情况。作为一个年轻的学院,受组织委托,创建一个连通性的平台生态系统,打造未来并连接世界。这是我们的运营模式。如果你能理解中文,我们的座右铭更具力量:“改变世界,引领未来。” ZIBS的优势在于其灵活性。我们规模适中,拥有大约1000名学生,来自72个国家,成为世界上最国际化的中国商学院之一。

Next, let's talk about the situation with ZIBS. As a young business school, to go beyond mere technical work and create an ecosystem of connected platforms that shape the future and connect the world. It's our operating model. If you can understand Chinese, our motto is even more powerful: " change the world, lead the future." The advantage of ZIBS lies in its flexibility. With around 1,000 students from 72 countries, we are one of the most international Chinese business schools in the world.

我们特别强调生态系统的建设,借鉴科技公司运作的模式。这也是为什么我们邀请了蚂蚁集团主席井贤栋加入我们的国际顾问委员会——并非因为他捐了多少钱,而是因为他带来了文化和启发。我们的合作伙伴涵盖了各行各业,仅列举其中一部分。如果你认为只有DeepSeek吸引了国际关注,那么你可能会忽视我们所谓的杭州“六小龙”,以及其他许多公司,它们在多个领域表现优异。总的来说它们也是我们生态系统的一部分。因此,浙江大学不仅仅是一所中国大学,它是拥有一些世界一流的资源的生态系统,是企业家精神的中心。我们与阿里巴巴、蚂蚁集团等公司有着紧密的联系。我期待有机会与大家合作,欢迎访问ZIBS。我的分享就到这里,谢谢。We place special emphasis on ecosystem building, adopting operation model of technology company. That's why we have Ant Group Chairman Eric Jing sitting on our International Advisory Board, not because he contributes a lot of money, but because he brings culture and inspiration. Our partners span a wide range of industries, to name just a few. If you think it's only DeepSeek that attracts international attention, then you might overlook what we call the "Six Dragons", and many more companies that excel in multiple areas. Overall, they form part of our ecosystem. As a result, Zhejiang University is more than just a Chinese university, it is an ecosystem with some world-class resources and is a hub for private entrepreneurship. We have strong ties with companies such as Alibaba, Ant Group, etc. I look forward to the opportunity to work with all of you, welcome to visit ZIBS. That's all for my sharing today and thank you.